P U R P L E F I N A N C E B L O G

Continental vs. Anglo-Saxon

Accounting in Odoo

Part 2: Practical implications

P U R P L E

F I N A N C E

B L O G

Continental vs. Anglo-Saxon

Accounting

in Odoo

Part 2: Practical implications

October 2025 | Finance & Accounting

The first part of this series of articles explained the fundamental difference between continental accounting and Anglo-Saxon accounting in Odoo. Now we will take a detailed look at the practical implications, particularly with regard to automatic accruals, intercompany postings, and the use of the cost of sales method.

Zu Teil 1: Grundlagen

Continue with Part 2 ⤵️

Automatic accrual

A major disadvantage of the “Continental” method is the need for clear demarcation. However, if this is done elegantly and largely automatically, it can be established as an integral part of the closing process. This promotes conscious engagement with the topic and improves the quality of the closing.

1) Accrual function in Odoo

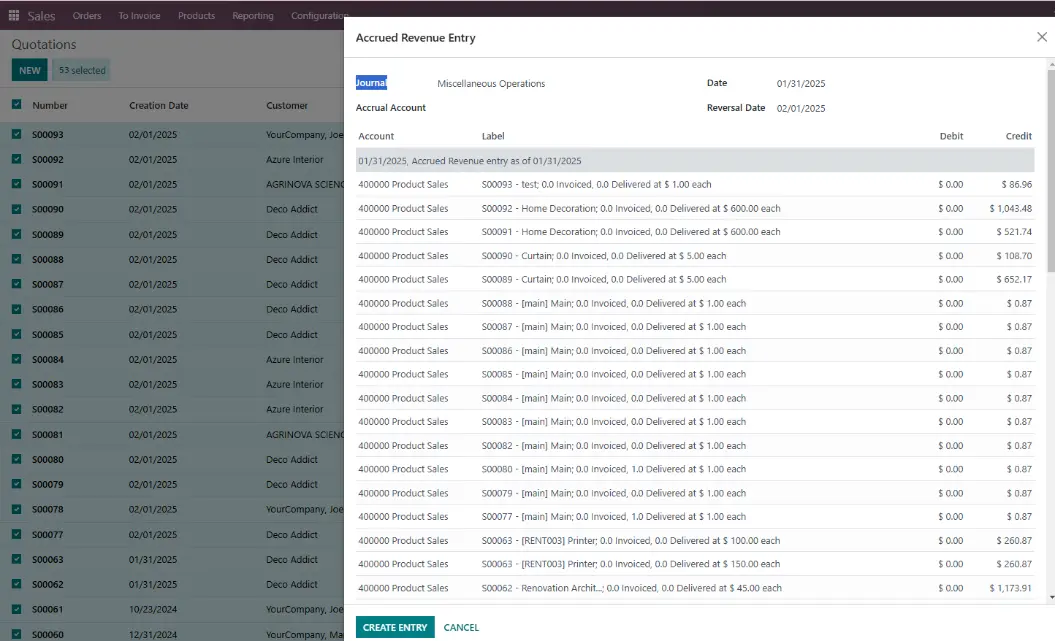

Since version 16, Odoo has offered a feature for separating purchase orders and sales orders. Despite its potential, this feature has serious shortcomings:

Lack of differentiation in sales: The accrual is not based on the quantities actually delivered and invoiced, but rather on the quantity ordered. This contradicts the principles of correct accounting (at least in Germany).

No reference to the reporting date: Accruals must be made retroactively to the balance sheet date. However, Odoo only offers a current view without the option of simulating the historical status on the closing date..

Insufficient account logic: The accrual is posted as a lump sum to a single account stored in the product and to a contra account defined in the accrual wizard. There are no differentiated accounts for different accrual scenarios:

Active account “Goods in transit” for posted invoices without goods receipt.

Passive account “Liabilities from outstanding invoices” for posted goods receipts without invoices.

Active account “Goods in transit” for posted invoices without goods receipt.

Passive account “Liabilities from outstanding invoices” for posted goods receipts without invoices.

Lack of tax consideration: The accrual is made to the account stored in the product, e.g., “Cost of materials 19%.” However, a tax-free accrual does not belong in this account. In addition, Odoo ignores intercompany accounts, which is problematic for internal group reconciliations.

No partner assignment: The accrual posting is made without partner information, which is particularly problematic for intercompany reconciliations.

2) Alternative with syscoon Accrual app

The syscoon “Accrual” app analyzes all orders and identifies differences between delivered and invoiced quantities. This offers the following advantages:

Troubleshooting: Companies can identify incomplete bookings at an early stage, such as missing invoices or unrecorded goods receipts.

Improved collaboration: Accounting, purchasing, and logistics can systematically reconcile open items.

Correct presentation of income statement: In the Anglo-Saxon method, the income statement is only addressed once both delivery and invoicing have taken place. This can lead to incorrect results, for example if an outgoing invoice has been forgotten.

Intercompany accruals: The app enables booking to special IC accounts with partner assignment, enabling fast-close consolidation regardless of invoice or goods receipt status.

The multi-company trap

In corporate groups, the question arises as to how to eliminate internal company (IC) transactions. If one company uses Anglo-Saxon accounting and another uses Continental accounting, inconsistencies arise during consolidation.

Example:

Company A (sale to B using continental accounting): Receivables VU to sales VU, BV to inventories.

Company B (purchase from A using Anglo-Saxon accounting): Stock Interim (Receipt) to liabilities VU, inventories to Stock Interim (Receipt).

While IC receivables and liabilities can be eliminated, the “Sales VU” account remains without a contra account, as there is no corresponding “Material expenses VU” account on the purchasing side. This prevents automatic consolidation. Even the IC journals suggested in Odoo do not solve this problem within the framework of legal consolidation.

Continental for President – Cost of sales method with Continental Accounting

Odoo allows the use of two inventory accounts: “Stock Input” and “Stock Output.” These accounts can be flexibly assigned in the P&L, depending on the desired procedure.

1) Total cost method

“Increase in merchandise inventory” and “Decrease in merchandise inventory” are assigned to the item “Cost of materials” or “Change in inventory UF/FE.”

The expense account is assigned to the cost of materials.

2) Cost of sales method with Continental Accounting

“Expense account,” “inventory increase,” and “inventory decrease” are assigned to the “COGS” item.

Since “expense account” and “inventory increase” cancel each other out, only “inventory decrease” remains – this corresponds exactly to the COGS account in the cost of sales method.

The posting “COGS to Stock Interim (Delivered)” otherwise required in the Anglo-Saxon method is omitted.

One disadvantage of the Continental approach is that analytical accounts (cost objects) are not automatically included in the COGS posting. However, this can be easily remedied with a few minor adjustments, but should be taken into account in the project.

Disadvantages of the Stock Interim Account

A serious disadvantage of the Anglo-Saxon method is the use of the stock interim account. This is addressed both actively and passively:

Active account “Goods in transit” for posted invoices without goods receipt.

Passive account “Liabilities from outstanding invoices” for posted goods receipts without invoices.